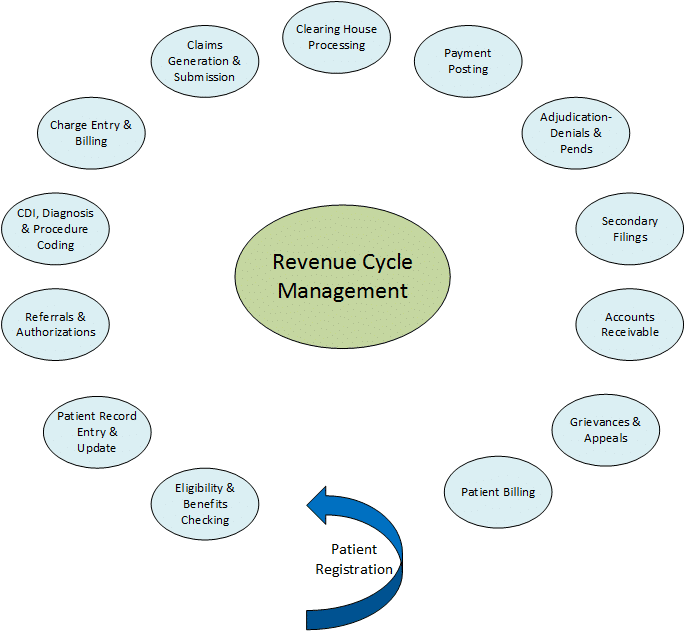

One operational area likely most impacted by the shifts in incentive regulations related to the HiTech Act and Accountable Care Act is revenue cycle management. The revenue cycle probably touches every aspect of the process to admit, treat, discharge, and finalize payment for services for an individual. A detailed view of the steps in the revenue cycle process is below:

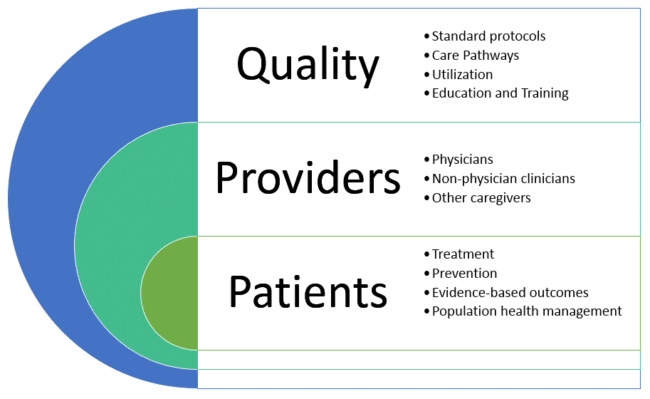

Despite the focus of healthcare reform being improved quality while decreasing cost, the most widely emphasized focus has been improved quality, which is easily understandable. Even HiTech-based incentives have been quality focused with Clinical Quality Measures (CQMs) being identified very specifically for Meaningful Use Stages. Cost containment incentives have been coming much more slowly and less specifically, with an initial focus on eliminating fraud and abuse in the Medicare and Medicaid programs.

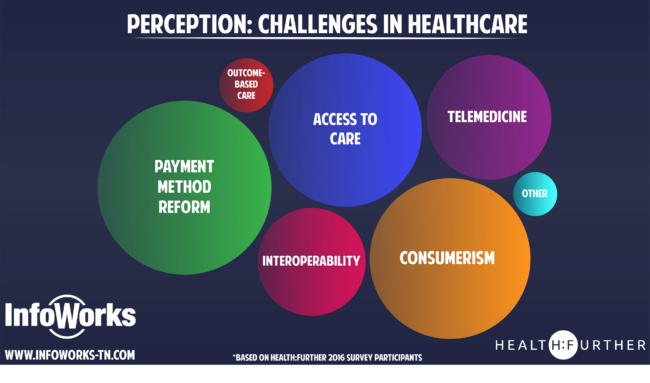

Traditionally, Medicare makes separate payments to providers for each service they perform for beneficiaries during a single illness or course of treatment, also known as ‘fee for service’. The unintended result of this approach has resulted in fragmented care with minimal coordination across providers and health systems in many cases. The approach tends to reward the quantity of services offered by providers rather than the quality of care delivered and associated outcomes. Bundled payments are intended to align incentives for ambulatory providers, hospitals, post-acute care providers, physicians, and other providers and eliminate this unintended consequence of fee for service payments. The success of bundled payments and other forms of Fee-For-Value versus Fee-For-Service imply the application oftwo basic practices: 1) collaboration of care management across the continuum, and 2) revenue cycle management that focuses on collection and analysis of clinical informatics related to both clinical and financial outcomes.

The combination of these two practices further implies that a level of transparency and shared analysis exists across the continuum of care related to information such as adjudicated claims data, and reimbursement impact of high priority Diagnosis Related Groups (DRGs). For ultimate success, the revenue cycle process illustrated above becomes a holistic view with common points of mutual fulfilment by ambulatory providers, hospitals, post-acute providers, payers, and others in the continuum of care, and versus the current duplicated efforts within each of those healthcare delivery settings. Such transparency further implies that there is a shared explanation of actual costs associated with the delivery of care in each setting.

These implications, accompanied by basic laws of supply and demand, and altruistic behavior towards patients and their families, are the primary drivers of change in revenue cycle management. Government incentives may be a good jump start to initiate change; however, each healthcare setting has a role in sharing information, setting goals and objectives in a collaborative environment, visualizing revenue cycle management as an operation that extends beyond its own doors, and establishing relationships that are mutual-value based partnerships.

When will new models become mainstream? We will see the shift in the next two years. The administration has set Medicare goals to have 30% of payments be in alternative payment methods and 50% by 2018. As healthcare organizations prepare to implement the bundled payment program for joint replacement as of April 1, 2016, the level of transparency and partnership across hospitals, rehabilitation centers, physicians, and durable medical equipment providers will accelerate as each organization or provider determines how to maintain some level of profitability with these new models. What will be included in the bundle? All related care within 90 days of hospital discharge from the joint replacement procedure will be included in the episode of care.

Is your organization ready for this change?